GEICO, one of the nation’s leading auto insurers, has announced an expansion of its partnerships for Advanced Driver Assistance Systems (ADAS) calibrations within its Auto Repair Xpress (ARX) program. Following its initial partnership with asTech, GEICO has now added Protech Automotive Solutions, a subsidiary of Caliber Collision, to its network. While GEICO frames this move as a win for efficiency and consistency, it raises significant legal, ethical, and industry-specific questions about the insurer’s growing influence over repair processes.

As a former GEICO adjuster, I’ve witnessed the inner workings of the company firsthand. GEICO has long emphasized efficiency, but recent decisions suggest that profitability has taken precedence over fairness—not just for repair shops, but even for their own employees. Conversations with current GEICO adjusters reveal that the company has recently eliminated profit-sharing benefits for employees, despite posting record profits. This raises an important question: how much is enough?

Legal Concerns Surrounding Vendor Mandates

GEICO’s push to standardize pricing and mandate specific vendors, such as Protech, introduces potential legal and regulatory risks.

- Anti-Competitive Practices: Directing ARX shops to use Protech, a company owned by Caliber Collision, creates a conflict of interest. By funneling calibration work to a vendor owned by a direct competitor of many independent repair shops, GEICO could be seen as engaging in anti-competitive behavior. This raises questions about whether these arrangements violate fair trade or antitrust laws.

- Insurance Oversight: Insurers are required to act in good faith under state regulations. Mandating specific vendors and pricing structures may blur the line between promoting efficiency and overstepping into repair shop operations, potentially infringing on state laws that protect the autonomy of repair facilities.

- Consumer Impact: If repair shops feel financially pressured to cut corners to meet GEICO’s standardized pricing, it could lead to subpar repairs. This raises liability concerns for insurers and repair shops alike, especially when it comes to ADAS systems that are critical for vehicle safety.

Ethical Questions About GEICO’s Practices

GEICO’s recent decisions also raise broader ethical concerns. Eliminating employee profit-sharing while achieving record profits reflects a pattern of prioritizing corporate gains at the expense of its workforce and business partners.

When an insurer directs significant revenue streams—such as calibration work—into the hands of a vendor owned by a major competitor like Caliber Collision, it creates an uneven playing field. This not only disadvantages independent shops but also undermines trust in the fairness of the repair ecosystem.

From a legal and ethical standpoint, the industry must ask: where do we draw the line between innovation and overreach?

Industry Impact: Undermining Repair Shop Autonomy

The autobody industry operates on thin profit margins, especially as the complexity of repairs grows with modern vehicle technologies. GEICO’s agreements with asTech and Protech impose constraints that exacerbate these challenges:

- Loss of Revenue: Repair shops are being directed to send calibration work—and the associated revenue—to a vendor that is also their competitor, reducing their ability to remain financially viable.

- Reduced Control: By centralizing vendor choices, GEICO is eroding shop autonomy and forcing them into agreements that may not align with their business practices or customer needs.

- Risk to Quality: Shops may feel pressured to prioritize insurer pricing requirements over OEM standards, which could lead to improper calibrations and safety risks.

What Needs to Change

This situation highlights the need for greater scrutiny of insurer practices, both from a regulatory and industry perspective. Independent repair facilities and trade associations must advocate for policies that protect shop autonomy, ensure fair pricing, and prioritize repair quality over insurer-driven cost savings.

State regulators should investigate the potential anti-competitive implications of insurer-vendor relationships, particularly when insurers like GEICO appear to use their influence to consolidate control over repair processes.

Ultimately, the question is not just about how much profit GEICO can achieve, but about whether those profits come at the expense of repair shop viability, employee satisfaction, and customer safety. GEICO’s record-breaking profits and recent cost-cutting measures suggest a company that has lost sight of balance. The autobody industry—and the customers who depend on it—deserve better.

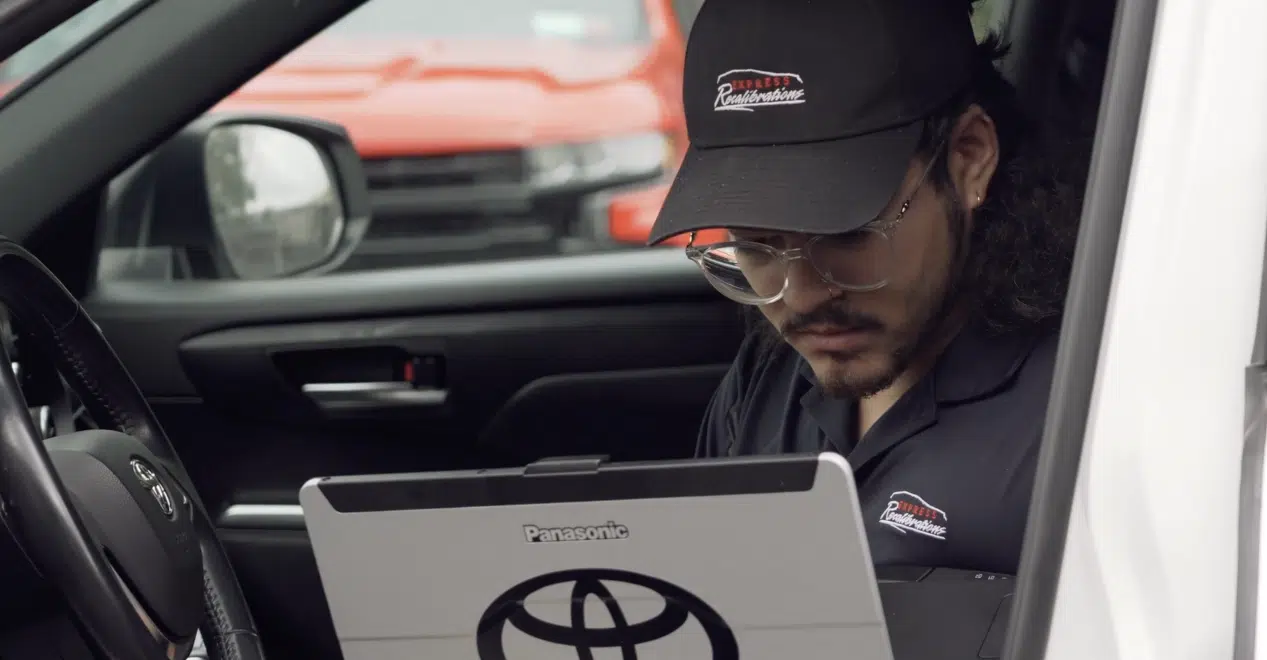

Partner with Express Diagnostics

At Express Diagnostics, we’re committed to helping autobody shops navigate the complexities of ADAS calibrations without compromising quality, autonomy, or profitability. We are ICAR Certified, Rivian Certified, and Ford ADAS Certified, and we proudly serve businesses in 8 states and growing.

Our focus is on providing high-quality in shop and mobile calibration services that align with OEM standards, empowering shops to deliver safe and precise repairs.

Call us today at 800-407-2327 to learn more about how a partnership with Express Diagnostics can help your business thrive in an ever-changing industry.

James Grimaldi

ADAS Rockstar